Before 1984, if you needed a generic version of a prescription drug, you were out of luck. Most brand-name medications had no affordable alternatives. The reason wasn’t lack of demand-it was the law. Generic drug makers had to run full clinical trials to prove their version was safe and effective, even though the chemical formula was identical to the brand-name drug. That meant years of extra time and millions of dollars in costs. By 1983, only about 19% of prescriptions filled in the U.S. were for generics. Today, that number is over 90%. The shift didn’t happen by accident. It happened because of the Hatch-Waxman Amendments.

What the Hatch-Waxman Act Actually Did

The Drug Price Competition and Patent Term Restoration Act of 1984-better known as the Hatch-Waxman Act-wasn’t just another piece of legislation. It was a deal. A hard-fought compromise between two powerful forces: big pharmaceutical companies that wanted to protect their profits, and generic drug makers who wanted to bring cheaper medicine to the public.

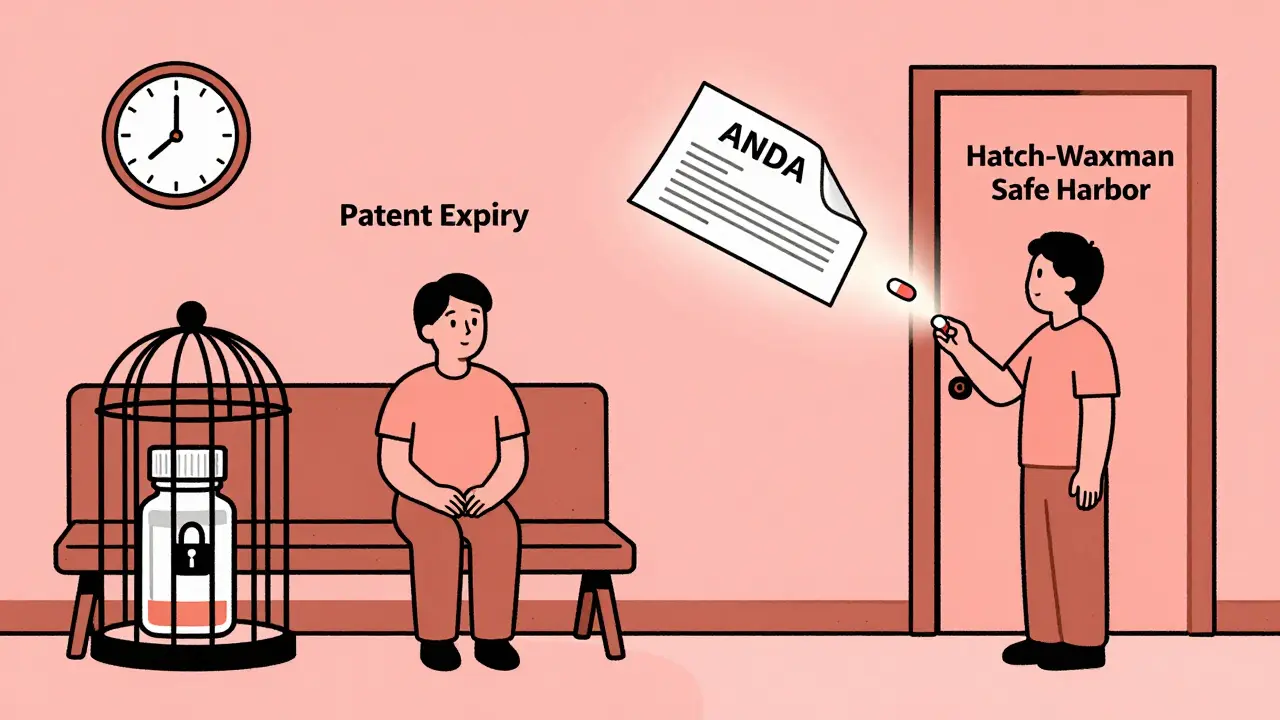

Before this law, generic companies couldn’t even start testing their versions until the brand-name patent expired. A 1984 court case, Roche v. Bolar, made it clear: using a patented drug to run tests before the patent ended was illegal. That meant patients waited years longer than necessary for affordable options.

Hatch-Waxman changed that. It created a legal loophole-called the “safe harbor” provision-that lets generic manufacturers test their drugs while the original patent is still active. As long as the testing is for FDA approval purposes, it doesn’t count as patent infringement. That single change cut years off the timeline for bringing generics to market.

The ANDA: The Engine Behind Generic Drug Approval

The heart of Hatch-Waxman is the Abbreviated New Drug Application, or ANDA. Before this, every new drug, even a copy, needed a full New Drug Application (NDA)-a process that could take a decade and cost over $1 billion. The ANDA changed everything.

Instead of running new clinical trials, generic makers only had to prove their version was bioequivalent to the brand-name drug. That means it delivers the same amount of active ingredient into the bloodstream at the same rate. No need to re-prove safety. No need to re-run large-scale studies. Just a few hundred patients, a few months, and a fraction of the cost.

That’s why generic drugs now cost 80-85% less than brand-name versions. It’s not because they’re cheaper to make-it’s because the regulatory burden was slashed. The FDA estimates that since 1984, the Hatch-Waxman system has saved U.S. consumers more than $3 trillion in drug costs.

Patent Term Restoration: Why Brand-Name Companies Got Something Too

Brand-name drug makers didn’t give up without a fight. They argued that the FDA’s approval process was eating into their patent life. A drug might have 20 years of patent protection, but if it takes 8 years just to get approved by the FDA, the company only has 12 years left to sell it before generics arrive.

Hatch-Waxman gave them a solution: patent term restoration. If a drug’s patent was delayed by FDA review, the company could get up to five extra years of market exclusivity. The total patent life couldn’t exceed 14 years after FDA approval, but that was still a big win for innovators.

They also got something else: regulatory exclusivity. A new chemical entity gets five years of market protection, even before the patent expires. If a company adds a new use for an existing drug, they get three years. Orphan drugs-those for rare diseases-get seven years. These weren’t patents. They were legal buffers to keep generics off the market longer, even if the patent had run out.

The 180-Day Exclusivity Trick

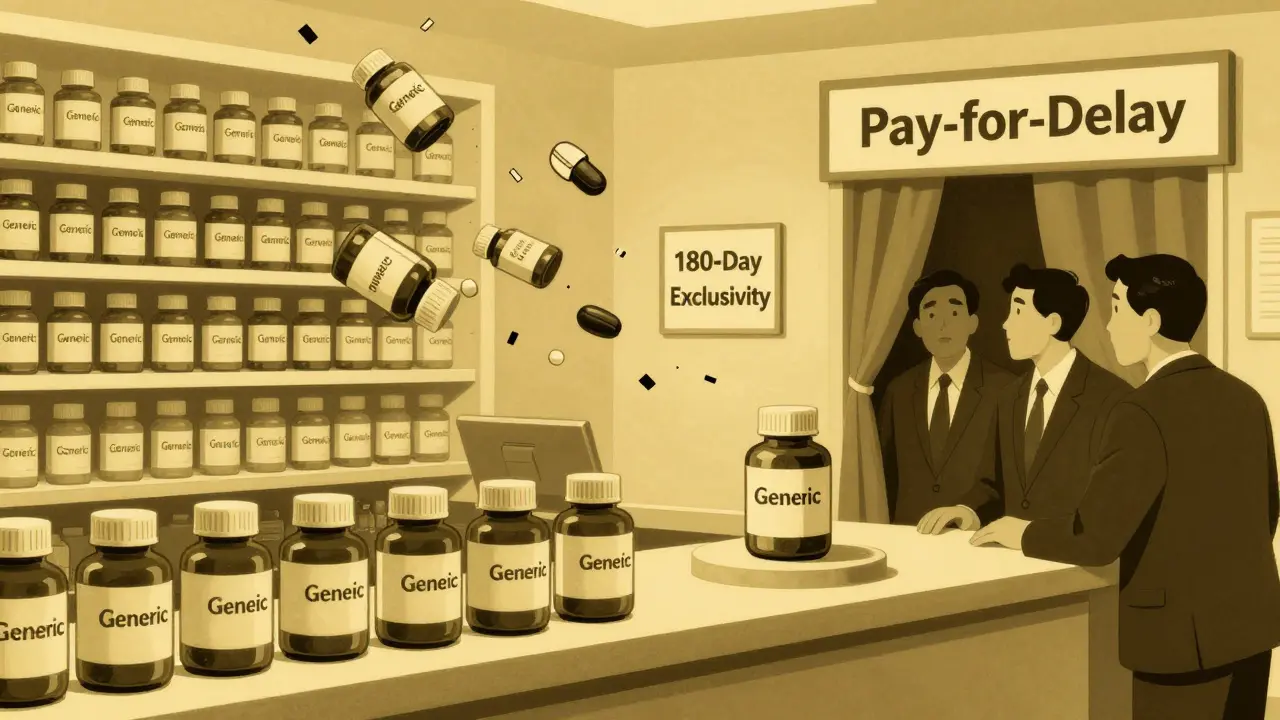

One of the most clever-and controversial-parts of Hatch-Waxman was the 180-day exclusivity reward for the first generic company to challenge a patent.

If a generic maker files what’s called a Paragraph IV certification, saying a brand-name patent is invalid or not being infringed, and wins the legal battle, they get six months of exclusive rights to sell their version. No other generics can enter the market during that time.

That’s a huge incentive. One company can make millions in those six months before others join. But it also created a race. Generic companies would file their applications the moment a patent expired-or even before-just to be first. Some even filed multiple applications on the same day, hoping the FDA would give them shared exclusivity.

It worked. The first generic to file often captured over 80% of the market during that window. But it also led to gamesmanship. Some brand-name companies would pay generics to delay their entry-what’s now called “pay-for-delay.” The Federal Trade Commission found 668 of these deals between 1999 and 2012, costing consumers an estimated $35 billion a year.

How the System Got Messy

Hatch-Waxman was designed as a balance. But over time, the scales tipped.

Brand-name companies learned to exploit the system. They’d file dozens of secondary patents-on packaging, dosing schedules, or delivery methods-to extend their monopoly beyond the original drug patent. This is called “evergreening.”

They’d also flood the FDA with citizen petitions-formal complaints that delay generic approvals. Sometimes, the petition had nothing to do with safety. It was just a tactic to buy time.

And then there’s the 30-month stay. If a brand-name company sues a generic maker for patent infringement within 45 days of being notified of a Paragraph IV filing, the FDA can’t approve the generic for 30 months. Even if the lawsuit is weak, it can delay competition for years.

These tactics didn’t break the law. They just bent it. And the cost? Higher prices for patients and insurers. A 2020 Stat News analysis called “unaffordable prescription drugs” the real legacy of Hatch-Waxman-not the access it created, but the delays it enabled.

What’s Changed Since 1984

The FDA didn’t sit still. In 2012, it launched the Generic Drug User Fee Amendments (GDUFA). This let the agency collect fees from generic manufacturers to hire more reviewers and cut through the backlog. Before GDUFA, it took an average of 30 months to approve an ANDA. By 2022, that dropped to under 12 months.

The 2023 Preserve Access to Affordable Generics and Biosimilars Act tried to crack down on pay-for-delay deals. It made it harder for brand-name companies to pay generics to stay off the market. But enforcement is still spotty.

Today, over 10,000 generic drugs are on the U.S. market. Nearly 9 out of 10 prescriptions are filled with generics. And they’re not just cheaper-they’re just as safe. The FDA requires them to meet the same quality standards as brand-name drugs.

But the system is still fragile. A single patent lawsuit can delay dozens of generics. A single pay-for-delay deal can keep prices high for years. The balance Hatch and Waxman struck in 1984 still holds-but it’s under constant pressure.

Why It Still Matters Today

Think about insulin. Or EpiPens. Or HIV medications. These are drugs people rely on every day. Without Hatch-Waxman, they’d cost three to ten times more. Millions of Americans wouldn’t be able to afford them.

That’s the real win. The law didn’t just create a faster approval process. It created access. It turned a system that favored corporations into one that gave power back to patients.

But it’s not perfect. The loopholes are still there. The incentives are still skewed. The next big fight won’t be about whether generics should exist. It’ll be about whether the rules still serve the public-or just the players who learned how to game them.

The Hatch-Waxman Act didn’t just change drug regulation. It changed lives. And its legacy? It’s still being written.

Colin Pierce

The Hatch-Waxman Act is one of those quiet heroes of modern medicine. I used to work in a pharmacy back in the early 2000s, and I’d see patients skipping doses because they couldn’t afford the brand-name stuff. Then generics started flooding in - same pill, 90% cheaper. People started taking their meds regularly. That’s not policy, that’s life-saving.

Mark Alan

AMERICA DID IT AGAIN 🇺🇸🔥 Generic drugs are proof we don’t need socialism - we just need smart laws that crush corporate greed. Hatch and Waxman were real patriots. Pay-for-delay? That’s treason with a law degree. #BreakTheMonopoly

Amber Daugs

Let’s be real - this whole system is a circus. Generic companies play dirty, big pharma plays dirtier, and the FDA just sits there like a bored librarian. And don’t even get me started on how some people think generics are ‘inferior.’ If you’re still scared of generics, you’re not being cautious - you’re being gullible. Wake up.

Ambrose Curtis

man i used to think generics were just knockoffs like fake nike shoes but nope - they’re the same damn thing. the fda makes em test bioequivalence so the body gets the same hit. i had to switch my blood pressure med to generic last year and my doc said ‘you’re not losing anything.’ guess what? i didn’t. saved me $400 a month. also the 180-day thing? yeah that’s a mess. some company gets rich for half a year while everyone else waits. it’s like a drug version of ‘first come first served’ but with billion-dollar stakes.

Robert Cardoso

The entire framework is a structural failure disguised as a compromise. The patent term restoration mechanism fundamentally distorts innovation incentives by artificially extending monopolies under the guise of regulatory delay. Furthermore, the 30-month stay is a legal loophole that transforms patent litigation into a strategic delay tactic rather than a judicial remedy. The $3 trillion savings figure is misleading - it ignores the externalized costs of delayed access, increased hospitalizations due to non-adherence during exclusivity windows, and the systemic rent-seeking behavior enabled by regulatory arbitrage. This isn’t progress - it’s regulated capture.

matthew martin

It’s wild how one law changed so much. I remember when my grandma had to choose between her insulin and groceries. Now? She gets her generic at Walmart for $25 a month. No drama, no guilt. The system’s got cracks - yeah, sure - but it’s still holding up millions of people. I don’t need it to be perfect. I just need it to keep working. And honestly? The fact that we’re even having this conversation means we’re paying attention. That’s half the battle.

Jeffrey Carroll

The Hatch-Waxman Amendments represent a rare instance of legislative foresight in the pharmaceutical sector. The balance struck between innovation incentives and market competition remains commendable, despite subsequent exploitation. The long-term societal benefits, measured in both economic savings and improved health outcomes, underscore the importance of evidence-based policy design. Continued vigilance is necessary to preserve the integrity of this framework.

doug b

Generics saved my dad’s life. He’s on six meds. Four of them are generic. Without Hatch-Waxman, he’d be broke or dead. Simple as that. Yeah, the system’s got flaws - but don’t throw the baby out with the bathwater. Fix the pay-for-delay stuff, sure. But don’t go blaming the law that made cheap medicine real.

Mel MJPS

i just want to say thank you to whoever wrote this. i’ve been on a generic for my anxiety for years and never knew the story behind it. now i feel less guilty about taking it. also, my pharmacist said generics are just as good - so i’m gonna keep taking them. ❤️

Kathy Scaman

Wait so the 180-day thing is like a monopoly reward? That’s wild. So the first generic company gets to charge full price for half a year? That’s not competition - that’s a prize. And the brand names just sit back and wait? Sounds like a rigged game.

Anna Lou Chen

The entire paradigm is a neoliberal illusion. Hatch-Waxman doesn’t democratize access - it commodifies health under the auspices of market efficiency. The ANDA framework reduces biological equivalence to a statistical proxy, ignoring pharmacokinetic individuality. The ‘savings’ are merely a redistribution of surplus value from patients to private capital - now with more regulatory veneer. This isn’t reform - it’s rebranding exploitation.

Mindee Coulter

So basically the law said ‘you can copy the drug but not the patent’ and that’s why we have cheap meds now. And the 180-day thing is like a bonus for the first one to try. Makes sense. I’m just glad I don’t have to pay $500 for a pill anymore.

Write a comment